PayPal Vs Stripe – Which is Right for Your WooCommerce Store?

If you take a look at the payment gateways supported by WooCommerce, you’ll see 95 results. These results include options like PayPal, Stripe, Square, Amazon Pay, Authorize.net, and First Data. Several more obscure payment gateways are provided as well, but the two most popular are PayPal and Stripe.

Part of this is because the Stripe and PayPal WooCommerce extensions are completely free, but it mainly has to do with reasonable rates, seamless transactions, and reputable business practices.

In short, they’re both popular, so the companies make good money and protect the users because of that. But as with all payment gateway conversations, it can get extremely boring trying to figure out the right answer. And this one isn’t any easier.

So, when you pit PayPal vs Stripe, which one comes out ahead? Keep reading to learn about the pros and cons, along with the answer to which one is right for your business.

The Benefits of PayPal for Online Business

PayPal has far more benefits than it does downsides, and much of this has to do with the size of the company. You’ll be hard pressed to find a country or bank that doesn’t work with PayPal. Not to mention, you have almost instant control over your cash.

Easy Integration with WooCommerce

As one of WooCommerce’s built-in default payment options integrating PayPal with your online store is simple – just verify your account and you’re ready to accept payments. But if you want to make checkout even easier for your customers, there are a number of free WooCommerce extensions, like the Express Checkout, you can use to make your customers’ shopping experience quick and easy.

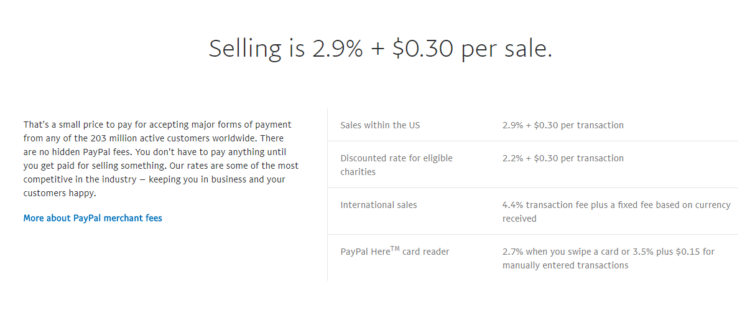

The Pricing is Easy to Understand

We’ll talk about how PayPal has more fees than Stripe (in the downsides section). But one thing is for sure: PayPal is transparent about all of its pricing.

The 2.9% +30¢ fee covers most transactions. You can also find some of the other fees here. In short, PayPal doesn’t seem to be trying to hide anything.

In addition, PayPal charges nothing for cancellations or downgrades. The same goes for setup fees.

You Can Get Numerous Services from One Place

Here’s a short list of just some of the services and products offered through PayPal:

- Recurring billing

- Micropayments

- Virtual terminals

- Payment forms

- Payment gateways

- Invoicing

Not every payment processing company provides everything like this under one roof.

PayPal Pays Out Fast

PayPal puts money in your account almost immediately after a transaction is made. You’ll have to wait a few days to transfer to another bank account, but there’s also the advantage of using the PayPal debit card.

PayPal is Accepted Almost Everywhere

Most buyers and sellers recognize the PayPal brand name. It’s a well-respected, trusted name in the business, so you can expect it to be accepted almost anywhere in the world. For this reason, it’s a wonderful choice for small businesses just getting started online.

It’s Easy to Configure

Whether you’re using a personal PayPal account or PayPal Payments Standard, you’ll have no problems when it comes to the setup. If there’s one thing you won’t hear merchants complain about it’s the ease-of-use with PayPal. Most newcomers can get configured with an account within ten minutes and start collecting payments even faster.

The Benefits of Stripe for Online Business

With payment processing, PCI compliance, subscriptions, marketplace tools, coupons, free trials, Buy buttons, and more, Stripe is known for its large feature-set. PayPal does a wonderful job of providing add-ons beyond its payment processing, but Stripe seems to beat it out.

A Wide Range of Additional Products and Services

PayPal’s services are pretty impressive, but Stripe supplements its payment gateway with some unique services like the following:

- Buy buttons for mobile apps

- Amazing reporting tools

- Marketplace options

- A customizable checkout

- A hosted payment page

- Subscriptions

- Free trials and coupons

And this is just a short list of the over 100 features provided by Stripe.

Quick WooCommerce Integration

With the addition of the free Stripe Payment Gateway extension for WooCommerce your online store will be all set to accept credit cards, Bitcoin, Apple Pay and more. Setup is straightforward and should require much time to configure your preferred payment settings.

Free Developer Tools

One of the main reasons you would go with Stripe over PayPal is because of its strong set of free developer tools. This allows developers a chance to quickly integrate the Stripe payment system into other apps, programs, and websites. The whole point is to set a solid foundation and open up options for expanding your business.

That said, Stripe is completely fine if you don’t have development skills. However, it does seem more appealing for developers.

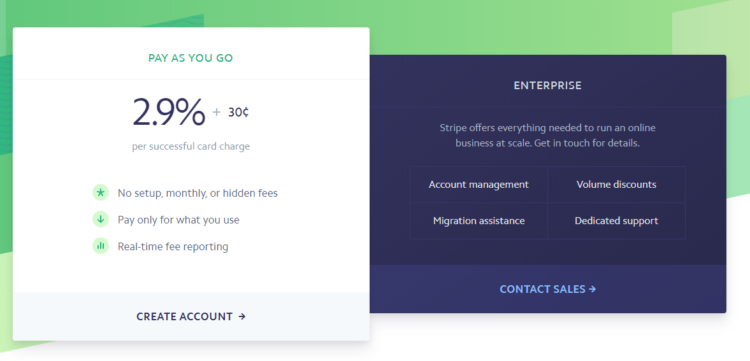

One Flat Fee

Both services have the 2.9% +30¢ standard transaction fee, but Stripe doesn’t charge extra for anything like for the authorization of a card, for international cards, or for charging cards from your site. We’ll outline the extra fees implemented by PayPal below, but businesses that want to accept international cards or do something like recurring billing will have fewer payments with Stripe.

Not only that, but Stripe accepts Apple Pay payments for free, while PayPal doesn’t accept payment from Apple Pay at all.

The Downsides of PayPal for Online Business

Being a large company, PayPal sees all sorts of complaints. Most of them have to do with the first point we address about frozen accounts.

Frozen Accounts and the Withholding of Funds

Although it’s clear PayPal acts on certain accounts due to security reasons, users have been known to report problems with frozen accounts and withheld funds, even for legitimate accounts. The reason PayPal typically freezes (or shuts down) accounts is because of suspected fraud.

PayPal has dealt with some high-profile fraud cases, so it makes sense that it’s a little wary of troublesome accounts. In addition, Stripe and other large payment processing companies are known to freeze or shut down accounts as well. PayPal just seems to be in the news more.

Overall, it’s best that you avoid PayPal if you don’t plan on following its terms and conditions. For instance, some companies have seen accounts frozen when trying to use personal PayPal accounts for business purposes.

Also, if you consider your product, service, or industry to be high-risk (or potentially illegal in some countries) you’re better off looking elsewhere.

Extra Service Fees

Since both PayPal and Stripe have the same standard transaction fees at 2.9% +30¢, there’s no reason to compare the two with that metric.

Stripe keeps things simple by sticking to their flat 2.9% +30¢ transaction fee. That’s it. PayPal, however, adds on some other fees depending on what happens with your account. Here are some examples:

- Chargebacks – $20 (As opposed to $15 for Stripe)

- Charge cards from your site – $30 per month

- Recurring billing – $10 per month

- Advanced fraud protection – $10 per month

- Fee to authorize a card – 30¢

- Fee for international cards – 1%

- Fee for payments less than $10 – 5% + .05¢

- Fees for American Express Cards – 3.5%

The majority of those fees from Stripe are either completely free or stick to the same flat rate of 2.9% +30¢.

Seller Protection

PayPal is famous for its buyer protection, but that’s not necessarily the case for sellers. You can take a look at the seller protection offerings here, but just keep in mind that many merchants report that the seller protection is far from effective.

The Downsides of Stripe for Online Business

Stripe is not without it’s challenges. Here are the ones you should be aware of.

Frozen Accounts and Terminations

PayPal and Stripe are both huge companies that encounter fraud around every corner. Therefore, it’s no surprise that merchants tend to also complain about frozen accounts with Stripe. So, PayPal and Stripe are on the same level in this category, since all merchants should at least be aware of the potential for frozen accounts. Once again, the best way to avoid this is by minimizing fraud on your site and using the Stripe account according to its terms and services.

It’s Not Always as User-friendly

Stripe packs quite a few features into its platform, but sometimes this causes more problems than it solves. To start, Stripe was primarily built for developers, so it’s not nearly as easy to setup as PayPal. In addition, fraud tools are included with Stripe, but customers seem to have trouble finding and activating them. For instance, Stripe has been known to not protect that well against fraud and chargebacks. Stripe definitely has features to fight these situations, but merchants have trouble turning them on and understanding them.

PayPal vs Stripe: Which Should You Choose?

It’s not all that easy to draw a full conclusion on which payment processor you should choose, but we can make a few solid statements:

- Stripe is better for developers.

- PayPal is usually better for newcomers who want a plug and play solution.

- PayPal has better rates for non-profits.

- Stripe has fewer fees for things like recurring billing, micropayments, and chargebacks.

- Although Stripe is popular, PayPal has much stronger brand recognition.

There you have it! If you have any questions about choosing between Stripe and PayPal, let us know in the comments section below.

Hi, nice article, but you don’t mention one of the biggest problems with PayPal: in several cases (or even randomly) PayPal, on the buyer side, does not let you pay with credit cards, but wants you to create a PayPal account. Reasons vary from using a browser which ‘knows’ about a PayPal account, from coming from a different country or simply ‘bugs’ (a.k.a. intended bugs) that hide the credit card option. You call PayPal and they admit the issue and send you back a long list of cases where this can happen. The excuse is fraud protection, but it is overplayed and exploited with the objective of forcing you to create a personal account. The result is extremely high bounce on the buyer side.

For this reason I am tempted to switch to Stripe; do you know whether it has the same ‘issues’ or not, by any chance?

Regards

Franco

Hmmm, I’ve not run into this with either payment system myself but perhaps another reader or author has some insight?

Yes, this is real. In fact I am looking at it right now, like I always did whenever I tried setting up a PayPal payment for my client’s website. Kinda got bored with ir so currently looking for comparison between PayPal and Stripe. And I ended up here. Trust me. it can happen even when you are testing it on Chrome Incognito mode too. You have to refresh the page a few time until that the “Pay with Credit Card” appears. But you still have to deal with another “create a new PayPal account” right at the bottom of the payment submission form. It’s kinda bugs people. Why not just collect the email and do email marketing or whatever later on. Geez..

Great Guide, much appreciated!

Stripe is also limited on the countries it is supported.

While, Atlas can be used to open an account, then there are extra costs coming to the table.

Been a provider with not so many merchants supported ( they have not added a new Zone / Country for a lot of time now, mostly as they want to promote Stripe ) it is hard to be a first choice from us also.

Paypal on the other hand is handling things based on behavior of Merchant and well, when you are doing a Business, you have to be legit!

I think PayPal is the right choice, but I had some issues while creating and setting up Sandbox account, fortunately I found a very easy to follow tutorial on Wpblog. They have explained the whole process in few simple steps, so do check it out. thanks

Another issue with PayPal… If you want WooCommerce onsite checkout you have to purchase PayPal Pro for $30 per month. Otherwise PayPal is going to take your customers offsite for checkout, which in our experience decreases the checkout rate….

This was really useful, as I have started using woo commerce for the sale of event tickets as an alternative to Eventbrite. The problem is that because I am in Italy and most of my customers are in international I am paying about 5% in fees to Paypal. It seems from your article that Stripe is better because it doesn’t whack on extra charges for pay pal. Let’s see! Thanks for a very clear article. Alice