Why to Use Multiple Payment Gateways for WooCommerce

You are running an e-commerce platform maintaining a single payment gateway and you feel that something is not working as it is supposed to be. Or too many customers leave each time when the checkout process begins.

If this is the scenario, then you are probably missing something very important that needs to be considered. There can be multiple reasons behind this phenomenon, but we’ll be focusing on one today.

When it comes to checkout, as a business owner, you want to make the whole process as convenient as possible. There are two types of payment gateways to complete the checkout process. One is a single payment gateway, and another is multiple payment gateways.

The idea of a single payment platform may seem easier, or smarter even. But having multiple payment gateways can offer you tons of privileges to help grow your business and make it more profitable.

A Couple of Statistical Viewpoints

Consumers usually tend to find their preferred payment gateway and if they can’t find their preferred way, they are likely to abandon the shopping cart.

One survey of Bymard Institute reveals that 6% of people left the payment process because of the lack of enough payment methods available. The same report shows that as many as 26% of customers abandon their cart when they feel the checkout process is more complicated than it should be.

Another point of Bymard Institute’s survey says that 19% of customers are dissatisfied about the credit card information. But they preferred to have multiple payment methods on the e-commerce system.

These percentages are really a healthy chunk of conversion!

Why Use Multiple Payment Gateways?

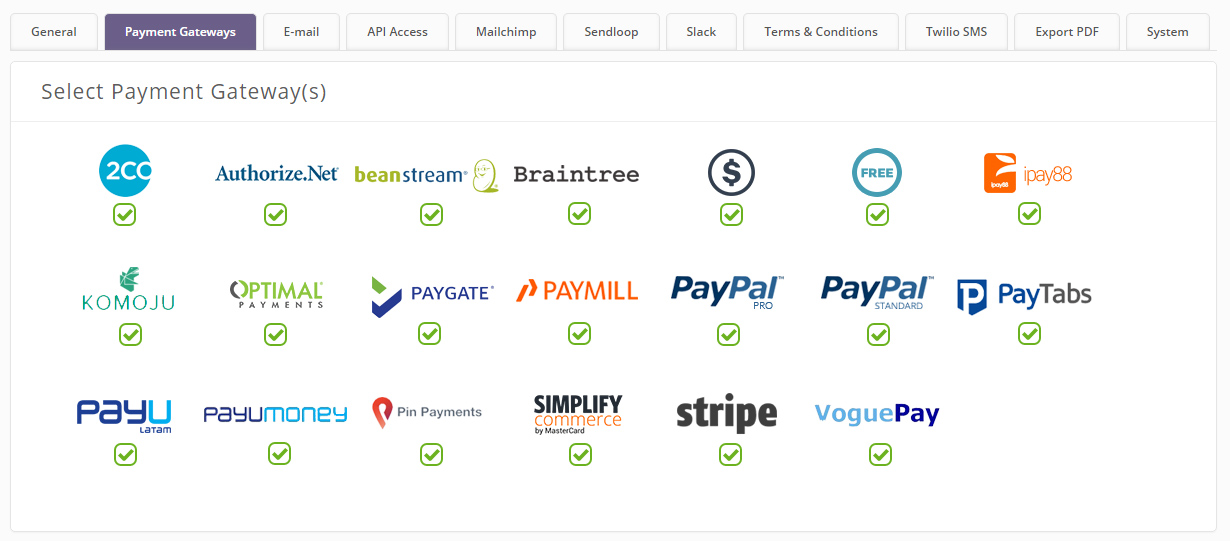

There are ample reasons for having multiple payment gateways on your e-commerce platform. As the challenges are growing fast, popular e-commerce options like WooCommerce connect their applications to multiple gateways to help facilitate business. WPExplorer has even covered the best WooCommerce payment gateway plugins before. So here are some of the key reasons why you should consider having multiple payment gateways on your e-commerce site.

1. Make Shopping Easier For Your Customers

The main purpose of a payment gateway is to process transactions for your business of any kind. To make this happen, multiple payment gateways can be the best option. It provides you with extended pay-ability and a high level of perceived professionalism, trust and legitimacy. All these attributes of multiple gateways are sure to make a convenient shopping experience.

2. More Ways to Get Paid = More Earnings

It’s a pretty simple concept, but multiple payment gateways increase your chances of getting paid. Using a single payment method limits your buyers and increases the chances of losing your customers.

An example can make you understand better. Suppose, you have an online store to sell your products and you only offer PayPal as a checkout option. In this case, the one-way payment method may not work with clients who are comfortable using Stripe, WorldPay or other payment methods. This also lessens the possibility of earning more. Though more options may increase some of your responsibilities, it could be the best bet for your business if your goal is to appeal to the widest number of customers.

3. Retain Customers

Existing customers are easier to manage than the newer ones, so always try to retain existing customers to maximize benefits. Moreover, they are cheaper to handle as well. According to Harvard Business Review, it costs 5 to 25 times more to acquire a new customer than to retain an existing one. It’s also easier to sell to someone who has purchased from you before. Trust has already been established. But the existing customers already know the payment method that you implemented on your site, you don’t need to spend time educating them like a new one.

However, it doesn’t necessarily mean that existing customers will continue to buy from you if you don’t care for their needs and preferences. They may change according to convenience and abandon older payment methods altogether if they become troublesome.

Hence, do offer something extra to feel them comfortable while staying with you. You can offer multiple payment methods to those customers who have bought from you for years. Customers always tend to see the changes and something new that is interesting.

4. Create Interest for New Customers

If you take care of your existing customers, you are already caring for your future customers. Today, potential customers often prefer to transact digitally whereas older customers like to use traditional ways like cash, debit card, bank transfers, etc.

So, to grow enough interest in the new generation customers, you need to introduce the latest technological advancements in the payment section as well. One of the best ways to make this happen is to illustrate to them that your company is up to date with the current trends. In this respect, you should offer them the best possible transaction options. This could mean adding Apple pay, or the ability to use Bitcoin.

Always keep in mind that in the cycle of the customer journey, you will find people with different tastes. Some will prefer to have a single payment method as it seems easy to maintain. On the other hand, there is a large number of millennials who could choose multiple ways of the transaction, so that hopefully new customers will be interested in your offerings.

5. Increase Your Scope of Payment

It’s a tough choice to stick to one option. The same thing happens for the payments. People love to feel and think independently and offering more payment options may make your store more compatible with their array of choices.

Multiple payment gateways increase the scope of payment processing, appealing to a wider audience. Relying on a single payment method can put you are at the mercy of a third-party system. And in this case, offering multiple methods will prevent reliability on those third-parties and systems. Moreover, you will have the self-sufficiency to enable your business to step forward.

6. Reduce Overhead Costs

Extending to more payment gateways may result in additional fees. But overall you can reduce your bottom line by spreading out your payment acceptance to include low cost or free options. This type of diversification could reduce overall costs.

If you use multiple payment methods on your site, you can start to separate the ones that are too expensive for you. For example, if your site received a chargeback Amazon Pay will assess a $20 fee, while Stripe’s is $15. You will see the end result will be spending less on processing fees as a whole.

7. Increase Total Sales

To increase total sales is what every business owner lives for! To make this happen you can start with WooCommerce marketing techniques. But creating a user-friendly cart system (that will ensure a convenient checkout process for clients) can also help.

Customers reach the checkout process aiming to make a happy purchase and you don’t want them to end up disappointed. A key reason behind such disappointment is often lack of payment methods they prefer to use. As a result, you lose the sale and more importantly, future sales.

8. Raising Cash Flow

You may not be able to flow in your cash if you only stick around a single payment method. Depending on the time and situation, you need to adopt the tools that are compatible with the time. If you don’t follow the demand of time, you might probably find an unexpected result in return.

So, make your payment method compatible with time and trend. In addition to this, you also can add cryptocurrency on your site. For example, there are many easy ways to accept Bitcoin with WordPress. This can raise your cash flow by adding extra value to your users.

9. Increasing Clientele and Audience

It’s pretty simple that if you have multiple options to deal, you are likely to have more people to engage with. When your expected customers are able to choose different payment options, you’ll likely have their preferred method available and they’ll be willing to pay easily. This will ultimately increase their participation as a whole too.

As the participation of clients increases, you are likely to have more agents for getting paid more or more often. Moreover, giving choices will also increase involvement which can play a great role in having a great turnover.

10. Expanding Geographical Coverage

It’s obvious that you need to have more than one payment at least if you want to expand the business, particularly in the different regions of the world. Some payment gateways may act as functional to some countries. For instance, you will find PayPal is conditional in India and functional in Bangladesh; so, if you want to cover those client bases, you need to adopt other payment methods in those geographical regions that are compatible with these countries.

Adding multiple payments will definitely take you to the next level and capture maximum geographical coverage. It will ensure the best support for a particular region in particular. As a result, you will have successful transactions through all the regions.

A payment gateway isn’t just a way to process payments, but a critical journey of your customers’ purchase.

Maintaining multiple payment gateways may increase responsibilities for your store but it offers more benefits than drawbacks. With WooCommerce, various WordPress plugins allow you to process online transactions for your business. And in our opinion, WordPress is the most convenient option as it not only works great for e-commerce sites but also offers multiple extensive generic payment gateway plugins for any particular purpose. So whether you want to add WorldPay or a basic PayPal checkout it has you covered.

In the end, it might be a good idea to add multiple payment options if you don’t want your business to be left in the dust. It’s a great way to appeal to a wider customer base and potentially increase overall revenue for your e-commerce business. I hope this article helped you much to know about multiple payment gateways and their usage.